Complying with the CBK’s CSF through Complyan

It is impossible to overstate the importance of cybersecurity. For financial institutions, the need to ensure that their systems and data are secure is even more crucial.

The Central Bank of Kuwait (CBK) has a comprehensive cybersecurity framework established for protecting their financial structure from cyber threats. Compliance with this framework is necessary and essential for financial institutions to ensure the safety of their operations.

The CBK CSF outlines the guidelines and best practices that financial institutions must follow to prevent, detect, and respond to cyber-attacks. The framework safeguards the confidentiality, integrity, and availability of financial data, systems, and networks. Failure to comply with the framework can result in significant financial losses, reputational damage, and legal consequences.

To achieve compliance with the framework, financial institutions need to adopt a comprehensive and effective cybersecurity solution. In this article, we will discuss how Complyan, a leading provider of cybersecurity solutions, can help financial institutions in Kuwait achieve compliance with the Central Bank’s cybersecurity framework.

Overview of the Kuwait Central Bank Cybersecurity Framework

The Kuwait Central Bank Cybersecurity Framework is a set of guidelines developed to help organizations in Kuwait protect their information technology systems from cybersecurity threats.

The framework is built on three principles: cybersecurity governance, risk management, and compliance, collaboration, and continual improvement.

The principle of cybersecurity governance, risk management, and compliance refers to the policies, procedures, and organizational structure an organization has in place to manage cybersecurity risks. As well as methods to identify and manage these risks while complying with relevant cybersecurity standards.

The collaboration principle emphasizes the need for efficient communication and coordination between different stakeholders within an organization, as well as with external stakeholders.

The principle of continual improvement refers to the ongoing efforts to improve an organization’s cybersecurity posture.

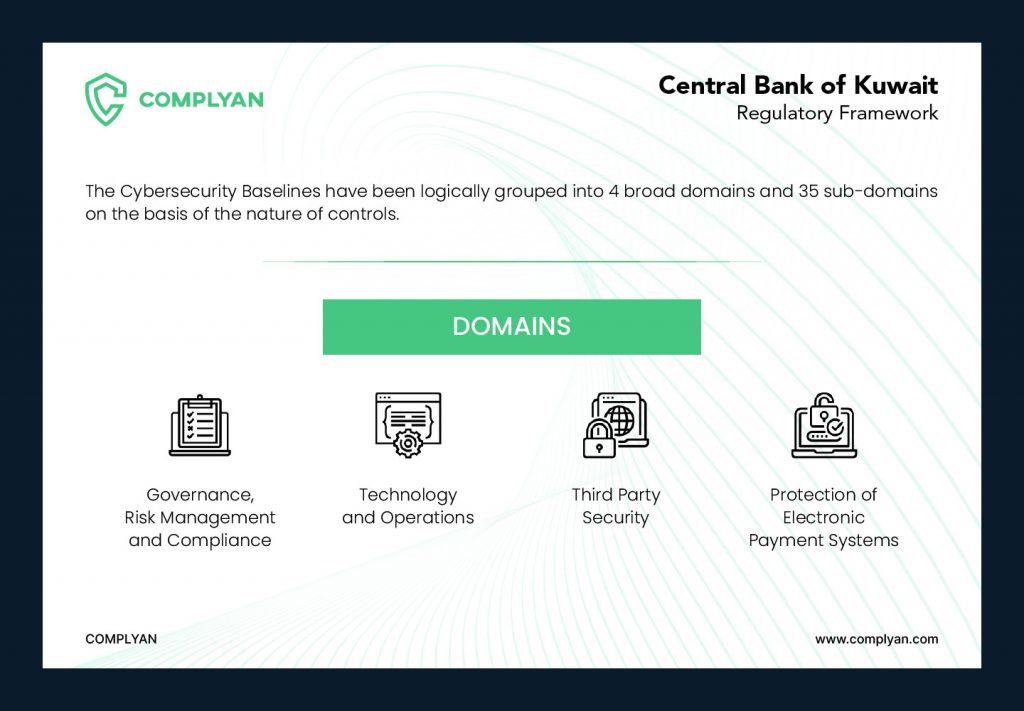

For the continual improvement principle, the CBK CSF outlined baselines of four domains and 35 subdomains, which collectively establish consistent cybersecurity controls within regulated entities and achieve the principles objectives

- Governance, Risk Management, and Compliance: This domain enables regulated entities to define a governance framework for effectively managing and mitigating cybersecurity risks. It also helps entities adhere to and track applicable global and local compliance requirements. The domain focuses on subdomains such as governance, cybersecurity strategy, and policy. It also includes risk management, and other subdomains with controls geared toward compliance with cybersecurity standards.

- Technology and Operations: This domain defines the baselines for securing the technology assets of regulated entities, helping them to identify, mitigate, and monitor technology risks. Security architecture design, asset management and classification, infrastructure security, and secure software lifecycle management are a few of the 21 subdomains under technology and operational security.

- Third-Party Security: Due to the heavy reliance on third party service providers, this domain gives specified controls that must be implemented to protect against risks arising from third-party service providers. It helps regulated entities identify, mitigate, and effectively monitor third-party risks. This domain handles security issues related to third-party outsourcing and cloud security.

- Protection of Electronic Payment Systems: This domain defines the baselines that must be implemented by regulated entities to identify, mitigate, and monitor cybersecurity risks related to payment systems. The domain provides controls under subdivisions of electronic payment systems, e-payment transaction monitoring, online banking, mobile banking, payment cards, POS, and contactless payment technologies.

The framework is designed to give organizations a holistic approach to managing cybersecurity risks. By implementing the framework, organizations can ensure that they have a comprehensive cybersecurity program in place to protect their assets and maintain their information’s confidentiality, integrity, and availability.

Importance of Compliance with the Kuwait Central Bank Cybersecurity Framework

The Kuwait Central Bank Cybersecurity Framework is an essential standard that all Kuwaiti banks must comply with. Compliance with the framework is crucial to ensuring the protection of customer data and sensitive financial information. By adhering to the framework, banks can also demonstrate their commitment to maintaining a high level of cybersecurity and gain the trust of their customers and stakeholders.

Compliance with the framework also comes with several benefits. First and foremost, it helps banks identify potential cybersecurity risks and vulnerabilities, allowing them to take preventive measures to avoid security breaches. This can help save banks from costly security incidents and reputational damage. Some other importance of the framework include:

- Aligning with the CBK cybersecurity framework can help banks stay updated with the latest cybersecurity standards, ensuring that they are equipped to tackle any emerging threats. Compliance can also help banks align their cybersecurity practices with international best practices, which can benefit banks operating in multiple jurisdictions.

- Complying with the Kuwait Central Bank Cybersecurity Framework is crucial for organizations in Kuwait to safeguard their critical information assets and ensure their business continuity. Failure to comply with the framework can result in severe consequences, including financial losses, reputational damage, and legal penalties.

However, achieving compliance can also be challenging due to the constantly evolving nature of cybersecurity threats. It requires a thorough understanding of the framework and its requirements and a significant investment in time, resources, and technology. As such, compliance with the framework requires a continuous effort involving understanding and correct interpretation of controls, sufficient planning and implementation, and understanding of the intersection with existing security protocols—all of which are offered by Complyan and its solution experts.

How Complyan Helps Achieve Compliance with the Kuwait Central Bank Cybersecurity Framework

Complyan is a leading provider of compliance solutions designed to help organizations meet their regulatory obligations. The SaaS solution is loaded with well-thought-out features that are tailored towards efficient implementation of the requirements of various cybersecurity frameworks. Complyan provides a suite of tools and services that address the requirements of the Kuwait Central Bank Cybersecurity Framework in the following ways:

- Information Security Management: Complyan provides comprehensive information security management solutions that enable organizations to assess their security posture, identify gaps in their controls, and implement effective security controls to protect their data and systems.

- Operational Resilience: Complyan helps organizations build operational resilience with their cyber and third-party risk management module. The modules help in understanding the risks an organization is exposed to and planning and implementing robust business continuity and disaster recovery plans in the event of an incident to minimize the impact of cyberattacks.

- Data Security and Privacy: Complyan offer a data security and privacy module with intuitive tools that help manage the privacy and security of sensitive information handled in the financial industry in accordance with the requirements of the CBK framework.

Using Complyan to achieve compliance with the Central Bank of Kuwait Cybersecurity Framework offers several benefits, including:

- Time and cost savings: Complyan’s solutions are designed to help organizations achieve compliance quickly and efficiently, with different pricing plans depending on your organization’s needs, thereby reducing the time and resources required for compliance with the CBK security framework.

- Expert guidance: Complyan’s compliance experts provide organizations with the guidance and support they need to achieve and maintain compliance with the framework.

- Risk mitigation: Complyan’s solutions help organizations identify and mitigate risks to their data and systems, reducing the likelihood of a security incident and the associated costs and reputational damage.

Governance and Policy Management

Governance and Policy Management